Identifying Pillar’s product-market fit

Background

I wanted to create a research strategy to fill in the information we were missing about the folks using Pillar. I sat down, coffee in hand, to document everything we already knew about our users, and I realized we had a problem—a big one.

Pillar is an app that helps people with student loans tackle their debt, and excluding general knowledge like:

There are 45 million Americans and counting with student debt.

11% of student debt holders are more than 90 days delinquent.

The average monthly student loan payment ranges from $200 to $299.

69% of seniors graduating with a four-year degree in 2019 had student loan debt (average debt of $30,000).

…the best information we had about our users was a few pieces of demographic data.

Most of our users were between 22 and 26.

50% of our users were making payments to more than one loan servicer.

Problem

We can’t build a product that resonates with users if we don’t understand their attitudes, struggles, and thought processes.

Goal

Learn about how recent grads approach loan repayment, including:

How they pick repayment plans

How they decide when and how much to pay

Where do they get their financial information from

So how might we learn more about our users…

Talk to them!

I set up a series of 30 interviews over the course of a week with users who:

Were between 22 and 25

since we knew that was the majority of our user base and the number of students graduating with loans was growing year over yearHad downloaded Pillar

which showed intent to pay back student loansHadn’t completed onboarding

which we assumed meant they didn’t understand the product or they didn’t think the product would meet their needs

And what did we learn?

Besides that even 22-year olds feel too old for TikTok…

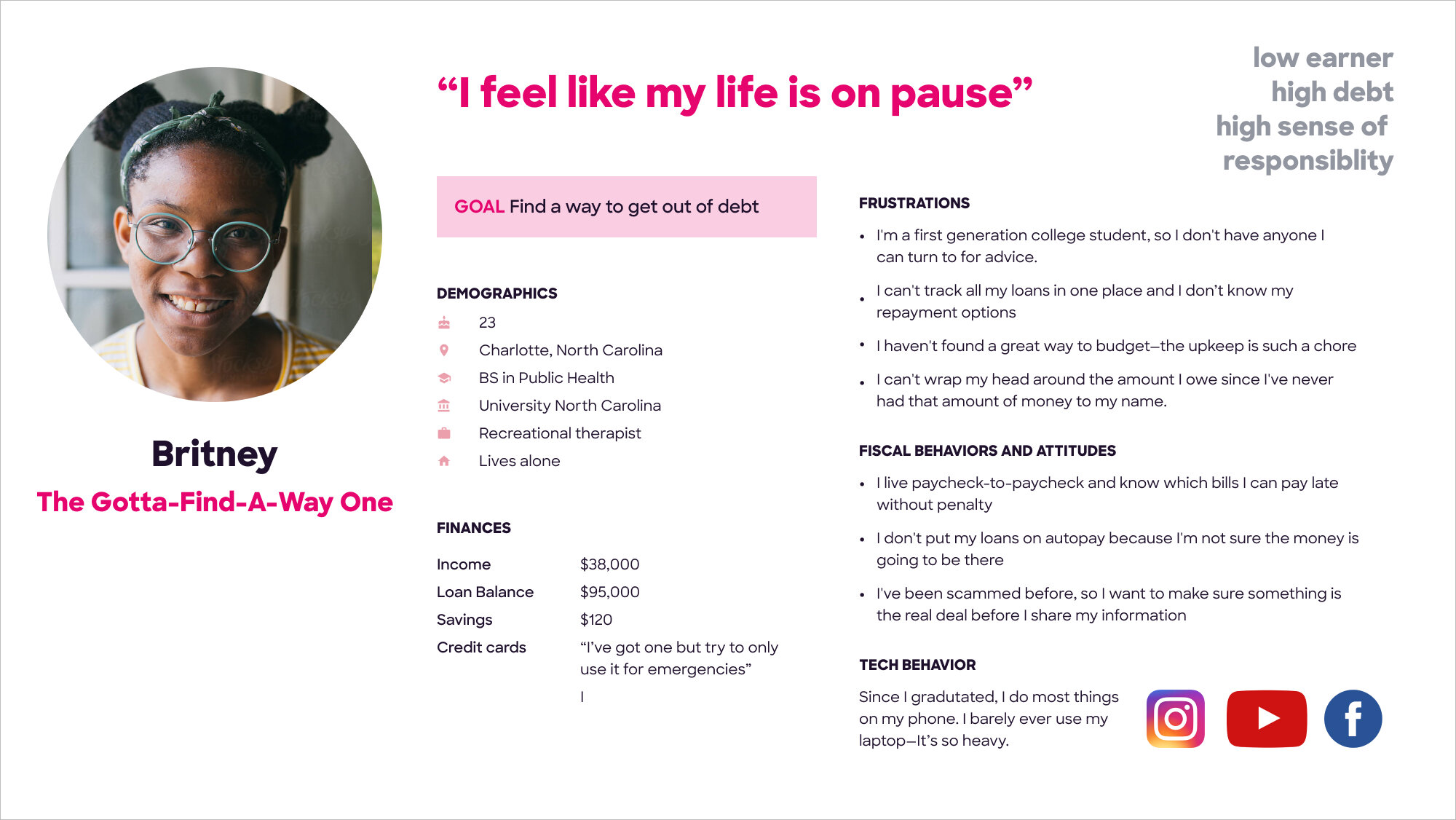

Interviewees who lived paycheck-to-paycheck were less likely to have their payments on autopay for fear of overdrawing.

First generation college students felt like they didn’t have anyone to turn to for advice.

Interviewees who were budget conscious were quick to reference Dave Ramsey.

Almost every interviewee cited YouTube as a source of financial education.

Most interviewees had tried Mint but abandoned it because the upkeep felt arduous.

Interviewees earning on average less than $50,000/year felt trapped by their debt, often not having a payoff date goal because the amount owed felt insurmountable. One interviewee stated, “It’s hard to conceive of how much money I owe because it’s more than I have ever had to my name.”

Interviewees who had extra money to put towards their loans were less likely to think they could be doing something different, and therefore expressed less desire to use an app to help them manage their loan payments.

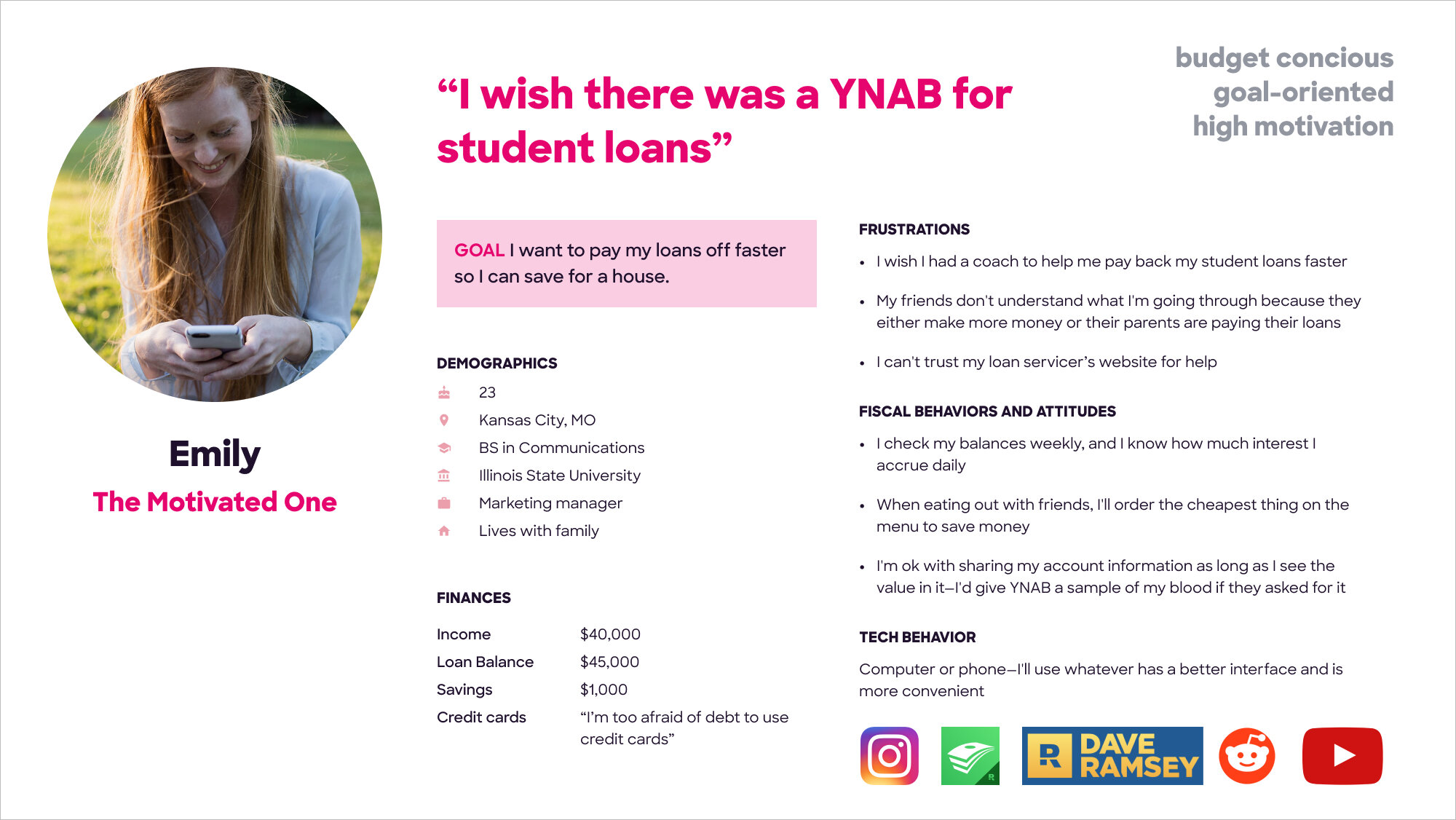

Building for the Emilys and Britneys

What we discovered was that even though our Mark persona was least likely to use Pillar, we had built features that mostly catered to their attitudes and challenges. Our greater opportunity lied with adding features that resonated with highly motivated personas like Emily and Britney.

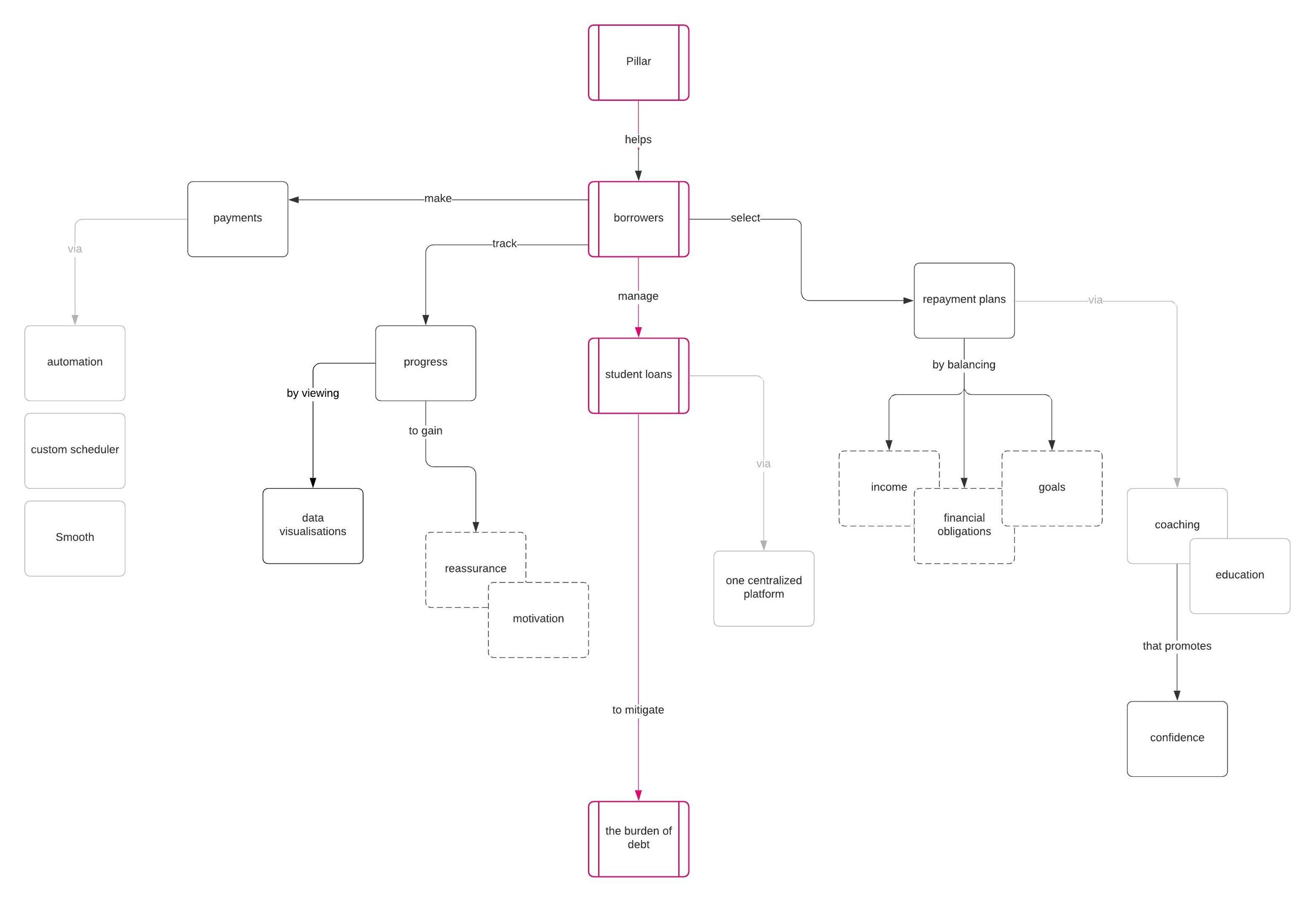

We started with a list of nouns and verbs from themes surfaced frequently in our interviews, and then used those words to form a summary sentence that would guide a product concept map.

Pillar helps borrowers manage their student loans by balancing their income, spending habits and goals to coach them on their best repayment plan and track their progress—all in order to mitigate the emotional and financial burden of debt.

Did the product concept map help?

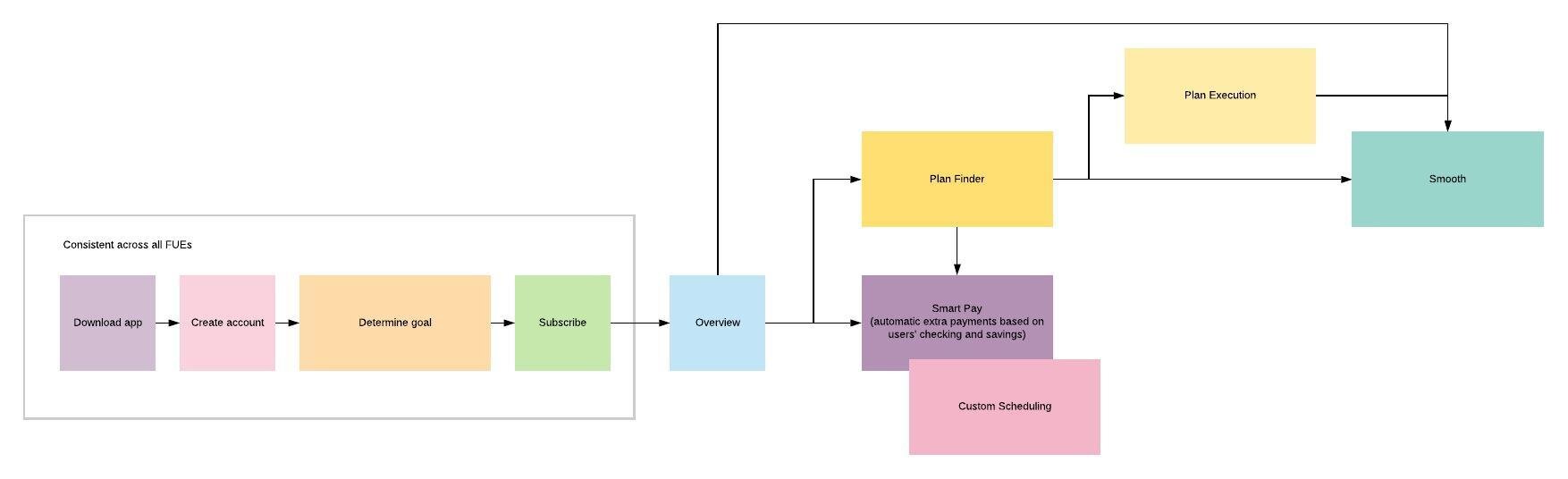

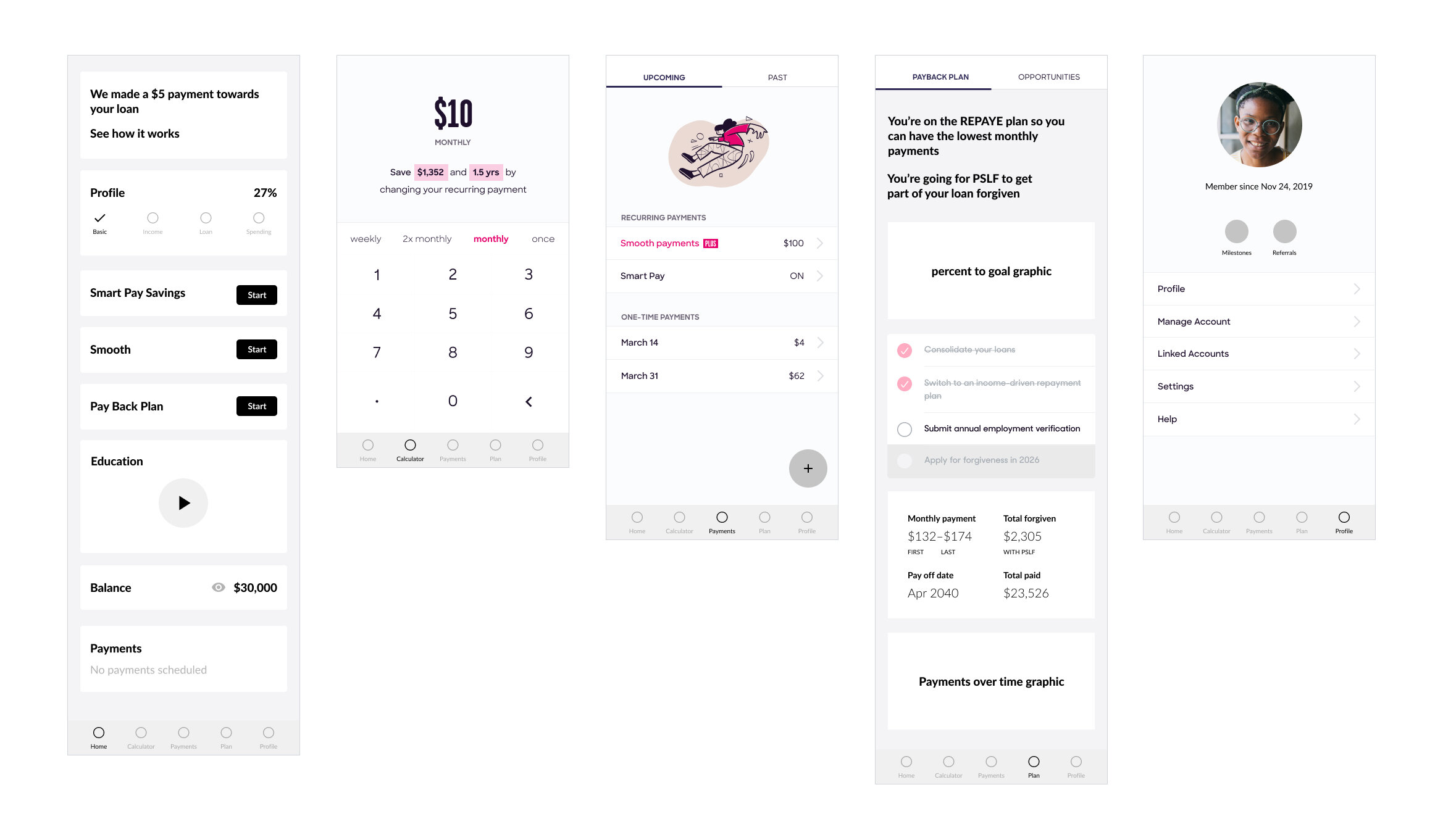

Yes! With the help of the product map and a one-week time box, we were able to determine hero flows and create wires for a 6-month vision.

Wireframes for a new tabbed navigation

Wireframes for a more engaging onboarding, as well as two new hero flows

Bonus: a shift in team morale

After presenting the research and the wires, the team—especially engineering—felt energized and relieved to have a solid direction.

“It’s great to have a better understanding of the direction we are heading in.”

“Seeing this will make it easier to make future-proof decisions and to know when I need to involve the backend team.”

More Case Studies

-

Accelerating therapist onboarding at UpLift

-

Using emotion to connect with borrowers

-

Getting internal buy-in to streamline onboarding